Talk to either a mortgage broker or bank and get advice on what you can afford, as without knowing your budget you will not know whether you can purchase a property.

Now you know how much you can spend, you must decide on which areas you would like to buy in. We would advise on taking multiple trips to different areas at different times of the day, to ensure an area is right for you. Be sure to always think of your commuting time and whether you need to be inside a catchment area of a school.

Decide on what you need from a property and see if your preferred areas offer this. If you need a three-bedroom house, however you can only afford a two-bedroom house in your favourite area, make the decision of whether you can make such a large compromise and possibly consider a new area. However always remember that you can usually extend a property, so if a house has potential, don’t immediately rule it out.

Now start searching... Call the local estate agents and register your details. You will need to explain what you are looking for in a property and always make sure that if you have any specific needs, always tell the agents immediately as to not waste anyone’s time i.e. minimum number of bedrooms, whether you need a garage, or if you need to be within certain proximities of travel links and schools. Giving an estate agent too much information of what you need is never a bad thing and it will only help you find what you are looking for.

So you’ve seen a few properties you like and decided to book some viewings. Go into every property with an open mind and imagine what it could be. Forget the colour of the carpets and walls, look past it and see if the size and area work. Cosmetic changes can always be made. Always be transparent with the estate agents as it will only help you. If you don’t like a house you have viewed, always tell them why. If you don’t they will never be able to know exactly what you want. Plus, every seller appreciates feedback!

Use this time to start obtaining solicitor quotes, as solicitor details will be one of the first things required when getting an offer agreed. Quotes can sometimes take a week to come back.

Now you’ve seen a house you like and want to make an offer. Before committing to a figure, check with your bank or mortgage broker to make sure that nothing has changed with your loan. Mortgage rates and lending criteria’s can always change, so ensure you are on top of your mortgage before making an offer. How much should I offer on a property? This all depends on you! Each house is individually priced and roads can vary, so you really need to do research and try to trust what the estate agent says. Obviously if there are similar properties at less money, always ask the agent what the difference is, as some roads may differ in price by huge amounts!

Now your offer is agreed you will have to appoint a solicitor. You will usually have to give the estate agent your solicitors details before they take a property off the market, so make sure that you have them ready. Usually your solicitor and bank/mortgage broker will work in sync, so make sure that everyone is prepped on you making an offer so they can get the ball rolling! This process can take between 6-10 weeks and depends on how fast the solicitor move and which lender you use! Sometimes this can be longer when chains are involved!

Feel free to contact Simmons Estates for any advice on buying a property and we will always try to advise you to the best of our knowledge.

Buying an investment property can be a daunting experience, as this will most likely be your largest investment. Making sure you purchase at the correct time, in the right area will determine whether or not you achieve good returns on your investment. Before purchasing a buy to let property you should do sufficient research to ensure that you are making the right decision with your money and ensure that you search for an area that has a positive buy to let market, as the last thing you want is a property that struggles to let, or even worse, costs you money.

Now, if you have decided that buy to let is for you then follow these steps:

There are multiple ways to finance a buy to let property and choosing the best option for you really depends on your personal finances. Some Landlords have the ability to purchase outright, however most choose to get a "Buy to Let Mortgage" allowing a much smaller cash output on day one. Usually lenders expect you to place a 25% deposit before they will lend, but should you need advice on the matter, let us introduce you to our independent mortgage broker and see what options are available to you.

Finding an area to invest in can be tough and you should spend most of your time researching different areas to ensure you invest safely. What should we do?

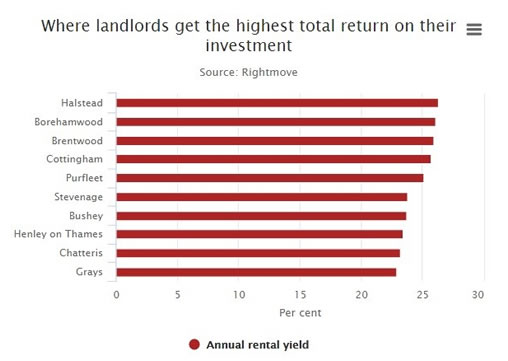

Start looking at different towns on Rightmove and compare purchase prices to rents, as this will determine your overall yield. Also look to see properties are letting and check accessibility to schools, shops and transport, as these will be your key points on whether an area is a safe investment. You need to decide on whether you invest locally or look to a new area where house prices are cheaper. If you decide to look out of the area you need to keep in mind that you may have to travel to the property to resolve issues and keeping it semi-local may be a wise move and an option most prefer.

Do I buy a house or flat? Deciding what is best really depends on the area, as some areas have a huge amount of apartments and others are saturated with houses. Ensuring you choose the correct type of property will determine your overall return from your investment.

How many bedrooms? You now need to look online and do some research into how many 1,2 or 3 bedroom properties are available at any-one time and possibly watch a handful to get an idea on how quickly different sized properties let. This is also very important, as having a property where there is lots of competition can lower your yield and give you longer void periods, so possibly count the numbers of one and two bedroom properties available and monitor which let quicker on a monthly basis. If you are looking to invest in our area, we can always assist with this information and are more than happy to do so.

The key point when deciding whether a property is right for you should be the return you are making. You should look at the difference in rental figures, as there may be a small difference in rent between 1 & 2 bedroom properties; however the difference in purchase prices may be substantial. Example: If one bedroom properties let for £1,000-£1,050pcm (per calendar month) and two bedroom properties let for £1,100-£1,150pcm, then you are only benefiting from £50-£150pcm. Now look at the sale prices – if one bedroom properties sell for £250,000 and two bedrooms sell for £325,000, is £100pcm worth an extra investment of £75,000? Probably not, as the return on the extra £75,000 at a rental amount of £100pcm is roughly 0.16% per year. This extra £75,000 could be used as another deposit and potentially offer return of 4-5%.

Always remember to purchase a buy to let with your head and not your heart, as you will not be living here and it should be looked at as a business that gives you the best returns.

Borehamwood as an area offers easy access to everything that is important to a potential tenant, with London bus links, great schools, a large shopping park, ranges of restaurants and a train that takes you to central London in under 30 minutes (it’s also the last stop in zone 6). The area also offers easy access to the A1 & M25, so commuters can get anywhere with ease. Borehamwood’s town has been full of investment over the past few years, with a constant influx of large brands and new restaurants opening every few months.

These points are very important when looking at an area to invest in, as an attractive and growing area always brings new tenants.

In 2015 The Telegraph voted Borehamwood as the 2nd best hotspot for buy to let returns, as London’s house prices outweigh the amount new investors are making from yields in the capital. Borehamwood was the 2nd best area that is benefitting from strong rental and house price growth, according to Rightmove.

"Investors and tenants who have been priced out of London and the South East have looked for better value areas in the East, and it seems they’ve found a winning formula. If you look at the top 10, six of the areas have asking prices below the national average, making it affordable for buy-to-let investors and tenants," said Sam Mitchell, head of lettings at Rightmove.

If you need any advice on investing, please contact our office, we are always happy to help.

When you decide to sell a property, you need to know how much your property is worth, as this will be vital in considering what your next move will be.

When you have booked the valuations for your property, ensure that you have questions ready for the estate agents, as preparing for a valuation is very important. You always want to know what the estate agents can offer you and where your property will be marketed to ensure you make the best choice. Always let the estate agent know if you are thinking of selling or if you just want an idea of price, as this can speed up the process for you.

How to choose an estate agent? Look for local knowledge and a solid history in an area, as you are entrusting one of the largest assets you can own and you NEED TO KNOW that the estate agent you are using knows what they are talking about, as having good local knowledge helps when negotiating on your behalf. How can an estate agent negotiate an offer for you if they do not know the history of an area and the difference of value between roads? Feel free to test us! Please understand that some estate agents will tell you what you want to hear just so you sign their contract, so don’t always think the highest price and lowest fee is the best option, as the last thing you want is your house going stale and not selling.

What should I do to make my house sell? Preparing your house for marketing is very important, as you only get one shot at a good first impression and this can be the difference in selling or not. Clearing your worktops and hiding paperwork is a must... Unfortunately photographs usually show off the mess in a property and make it look worse than it is, so spending a weekend clearing any not needed good can literally be worth a small fortune! It is always worth considering getting a cleaner in for a once over, as what is £100 when you are selling a property worth hundreds of thousands!

Now the estate agent knows you are selling and the house is prepped, arrange for us to visit you in daylight to take good quality photos and draw up the brochure. Good photos and a good description of the property is very important, so if you have any special features that you think add value, always point these out as they can be very positive in the details and add something different. Once the details are created we will send them to you for approval and start marketing at your request. We always want to know if our sellers have any contributions to the property details, as they know the house better than anyone and sellers can add a unique input to make their property stand out.

Tip: Always de-clutter, as having a house that looks too busy can make photos look bad and make it very hard for some buyers to see through any mess.

If you decide not to move immediately, always keep in touch with us, as UK property prices increase at rapid levels and you may need to update yourself at least once a year to stay on top of the prices. Especially if you are located in London or surrounding boroughs! Hertfordshire property prices have increased at exceptional levels year on year!

The first thing to do when looking to rent is to work out your budget and make sure you never over stretch yourself. This simple calculation can give you an indication of what is affordable (30x the monthly rent should be below your annual salary). So if the rent is £1,000pcm (per calendar month), you really need to be earning over £30,000 to pass the affordability checks. Also remember that you will have to give a deposit at the start of the tenancy and this can equate to one month rent or above.

Now you know what can spend, you need to find an area that offer’s property which meets your criteria. Start looking online for an area that has easy access to your work and also schools, if required. Once you find an area that ticks your main boxes, you now need to start registering your details with the local estate agents and viewing properties.

Now you have an area and you have started looking at properties, it is time to start making a decision. If you see a property you like you should consider making an offer and discussing your views with the estate agent. I would never take too long to think, as attractive properties can be let within days of the first viewing. If you find somewhere and have your offer accepted, the agent will take more details from you and start the referencing checks.

When renting a property, estate agents will have to reference you to ensure they are happy with your earnings, credit and any other previous landlord references. This is very standard and it will only validate anything you tell us when you start your search. Before you start viewing properties, ensure you tell the agents about anything that could come up as negative in the referencing i.e., a CCJ. If you are open about any potential negatives you should not have an issue, however if something comes up on the credit check that you have not disclosed, then you may lose the property.

Hopefully you have found a property and the references have passed, so the next steps will be to arrange a moving date, transfer the agreed funds and sign the tenancy agreement. Once this is done the agent can give you the keys and you can move in. You should always ask who will be handling your property and whether you should contact the agent or Landlord with problems in the future. Usually the agent should be happy to help and deal with certain issues.

Letting Valuation

If you have a property you wish to let out, you should start by finding out how much the property will rent for. Getting up to date valuations is vital, as letting figures can change year on year and taking the time to update yourself should be your number one priority, as you need to ensure that buy to let is affordable for you. During the valuation, you should ask the estate agents as many questions as possible to ensure that you make the best choice when letting out your property.

Choosing an Agent

Choosing the correct letting agent to handle your property is extremely important and this should not be taken lightly. How to choose the right agent? You should start by looking at what was discussed on your valuation and decide which agent was the most knowledgeable and experienced in the area, as they will be the ones that understand what you need and should offer a better quality service. In buy to let, choosing the wrong agent could cost you thousands as you may find low quality tenants that don’t pay or damage your property. Some landlords end up with a property that is vacant which will cost them thousands!

Getting Ready to Let Out

If your property is vacant you should always ensure that it is presentable. Having a property that is clean and in good condition is very important and this could be the deciding factor in a tenant letting the property. Spending a few hours cleaning or arranging for a company to come in could save you a lot of money between lets. If the property is occupied, you should tell the tenants to keep it clean and clutter free for viewings, as these things could put new tenants off.

What You Need

Before a tenant can move into a property, the landlord will have to ensure the property is safe for letting. There are lots of regulations that have to be met before you can legally let a property and being up to date with them is very important and should not be taken lightly. We offer our Landlords free advice!

Here are some important things you will need to have before and during the tenancy:

We believe that a tenant and landlord should show respect to one another, ensuring a smooth letting process for all. On occasion there will be issues to deal with and making sure your tenant are living in a safe environment is vital in keeping a good relationship with them and most importantly, that you are meeting your legal requirements as a landlord. We advise dealing with any issues immediately, as a leak or any kind of fault will only get worse and cost you more to repair in the future. Any of our landlords can call us at anytime for advice on whose responsibility a repair is.

Rent Collection - 8% plus vat (9.6% inc)

Full Management - 10% plus vat (12% inc vat).

Additional Charges:

Charges for serving legal notices - (£100 plus vat)

Charge to secure deposit - (£30 plus vat) (£36 inc vat) Included in Management

Charge to do inventory – (Up to £500 depending on property size)

Charge for property inspection – (£75 plus vat) Included in Management